RECAPITALIZATION

Business Recapitalization Services

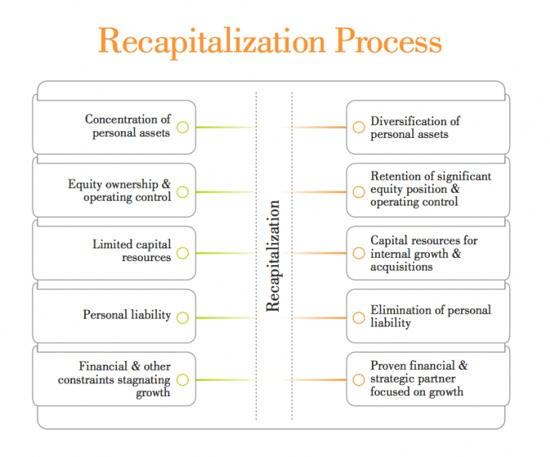

A lower middle-market company with a market value of at least $5 million could generate interest in a transaction that is structured as a private company recapitalization (recap). In contrast, to other M&A strategies, a recap provides the owner with additional flexibility and broader range of advantages – both financial and personal.

Recapitalization can, in fact, be “the best of all worlds” to an entrepreneur in terms of a liquidity option. In summary, it means: continued operating control, flexible exit choices, the opportunity to realize personal goals for the business and, most importantly, the prospect of maximizing financial gain.

RECAPITALIZATION

Connecting Florida Business Investors with Florida Businesses Seeking Recapitalization

RETURN ON INVESTMENT

The primary interest of an equity investor is to obtain the highest possible return on investment (ROI). Investment Firms – who may have $100 million to $5 billion in a private investment fund – seek to partner only with successful entrepreneurs with a proven track record.

They will target companies with a specific profile:

- Solid historical growth

- Strong and consistent profitability

- Industry dynamics indicating growth

- Willingness of ownership to work with an investor

- Ownership objectives aligned with investor goals

- Experienced senior management to implement growth plan

As the objectives of business owners vary, so do the goals of participating principles. One element, however, remains constant: their focus on, and commitment to, the future success of the enterprise. The means, by which the ultimate goal will be reached, will depend upon the investor and the agreement of the partnership: it could involve internal growth, expansion through acquisition, or a combination of both.

THE PARTNERSHIP

Entrepreneurs who have functioned in the sole leadership role for many years may initially resist the idea of having a partner. While dealing with an individual investor may, indeed, require relinquishing some control, a partnership involving a private equity group is quite different: private equity groups are not interested in the day-to-day operations of the business, but rather in supporting management to achieve significant growth and profitability.

Clearly, the partnership resulting from a recap will achieve maximum profit through growth. After providing access to new capital, the financial partner is fully prepared to have the owners use their expertise and do what they do best – operate and grow the business.

Major decisions involving acquisitions or going public, are made jointly. Furthermore, the equity groups generally recognize the value of the owners unmatched expertise in their business and industry and will look to them for direction on important issues.